Home buyers in Kingston must earn a massive £114,000 a year and have £57,000 squirrelled away in savings to get on to the borough’s property ladder.

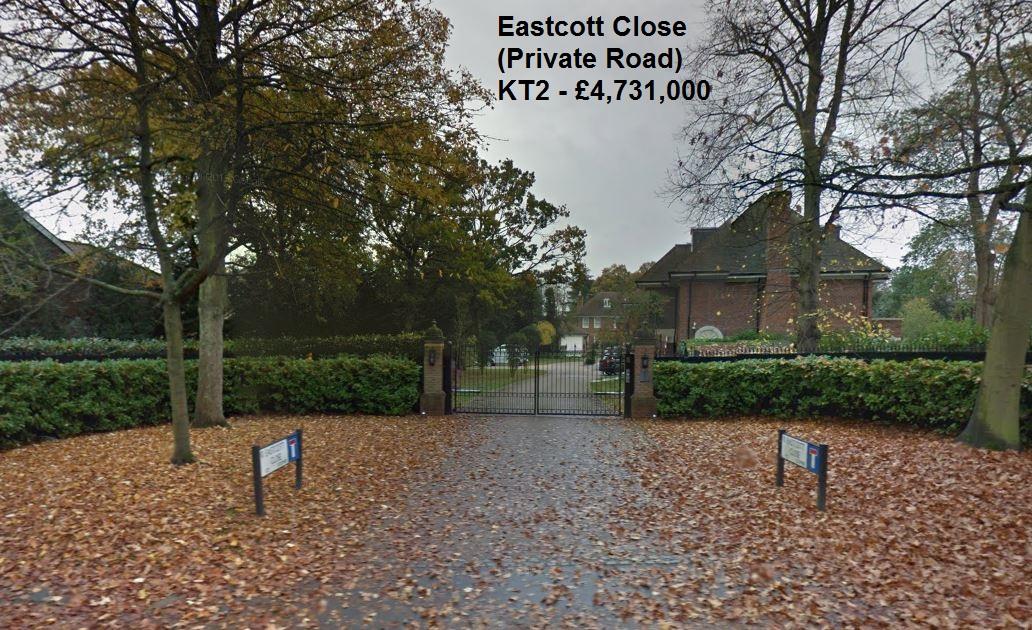

- Scroll through the photo gallery above to see where some of the cheapest, most expensive and averagely priced houses in Kingston are located.

The average Kingston resident brings in a £32,000 salary, according to Kingston Council figures, and owning a home of their own seems increasingly unlikely without significant financial help, particularly for the younger generation.

House prices in Kingston are soaring by more than 5 per cent a year, and the average home now costs £570,747 – almost £150,000 more than five years ago.

Mortgage lenders expect prospective buyers to put down a 10 per cent deposit and borrow 4.5 times their annual earnings.

Across the country, one-in-five young adults aged 25 to 29 still live with their parents, the Office for National Statistics has said.

Ellie Watmuff, 28, grew up in Richmond with her parents and was saving to buy a house in south-west London. She moved out and became a renter last year.

She said: “Despite having a good career with a decent salary, the only viable way for me to be able to save anything towards a home of my own with my then-boyfriend was to continue living with my parents into my mid to late twenties.

“The impact this choice had on my personal life was huge. Following the breakdown of my relationship, I abandoned plans to be a homeowner so I could stop living life ‘on hold’.

"I balk when I consider the amount of my pay that goes into rent and bills each month, but owning a home in London is something I’ve accepted will not happen unless I win the lottery, so I’d rather enjoy the lifestyle of living in a big city while I can instead of worrying about mortgage repayments.”

Kingston and Surbiton MP James Berry, who has just bought a home in Surbiton, said residents might have to get used to “tower block living” if there are to be enough homes to go around.

He said: “My main concern is people who work as teachers, nurses, and so on not being able to afford to move into homes in Kingston.

“Most people you speak to agree we need more houses but, in Kingston especially, gaining planning permission is difficult.

"We have to encourage more affordable homes and shared ownership schemes. I don’t like tower blocks but they may be one of the answers.”

Lawrence Hall, from property website Zoopla, said: “Kingston is expected to continue performing well given the amenities and attractiveness to families who may have been priced out of more central London locations.

"This appeal is reflected in the fact that the average value of a property in the borough has increased by almost 5.19 per cent in the past 12 months alone.”

Justin Gregory, 27, has just bought his first home in Surbiton, but said he would have had no chance of getting on the property ladder without his parents’ help.

He said: “Having your own home gives you more flexibility and property is the best investment. I lived at home for three-and-a-half years before buying. I didn’t pay rent and my parents helped out with the deposit.

“Without their help I would not have been able to buy for years.”

- Got a story? Call the newsdesk on 020 8722 6318 or email rachael.burford@london.newsquest.co.uk.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel